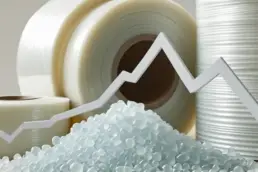

The Indian polymer market is showing stable momentum, with LLDPE and LDPE witnessing gradual demand growth, while HDPE continues to thrive on strong industrial and infrastructure requirements.

LLDPE demand reached around 2.0 million tonnes in FY2022 and is projected to rise to 3.70 million tonnes by FY2030, driven by sectors such as packaging, agriculture, and automotive (ChemAnalyst, IMARC Group).

LDPE demand stood at roughly 650 thousand tonnes in FY2023 and is expected to reach nearly 1.10 million tonnes by FY2035, supported by growth in packaging films, containers, and shrink wraps (ChemAnalyst, Research and Markets).

HDPE demand remains firm, particularly from infrastructure and construction sectors, although detailed pricing data remains limited (indianpetrochem.com).

Polymer Market Drivers

- Packaging & E-Commerce: Rising use in flexible packaging and stretch film is propelling LLDPE demand (IMARC Group, globalriskcommunity.com).

- Agriculture: Increased usage in irrigation pipes and greenhouse systems is further boosting LLDPE adoption (IMARC Group).

- Policy Support: Initiatives like the PLI scheme and petrochemical zone developments in Gujarat and Andhra Pradesh are expanding domestic production capacity for all PE grades (Markets and Data, IMARC Group).

Outlook

LLDPE and LDPE are set for sustained growth, backed by strong demand from packaging, agriculture, and emerging industries. Meanwhile, HDPE continues to benefit from resilient demand in core industrial sectors, with all three polymers gaining from favorable domestic policies and capacity expansions.

Stay ahead of market trends with the Credco app. For any queries, reach out via WhatsApp at +918448083211.